What happens when private equity companies take over company pension plans? Athene, a life insurer owned by Apollo, is a leading example.

Athene is acquiring a growing number of corporate pension plans, like AT&T, JC Penney and Lockheed Martin. When it does that, Athene takes on the pension obligations, issues annuities which pay those obligations to pensioners, and then re-invests pension assets. When Athene or other insurers take over a pension plan, the pension obligations “…lose the backing of the Pension Benefit Guaranty Corp., which backstops workers’ benefits if their pensions become insolvent,” says The Wall Street Journal. [1] This is because the federal Pension Benefit Guaranty Corporation does not guaranty pension annuities issued by an insurance company.[2]

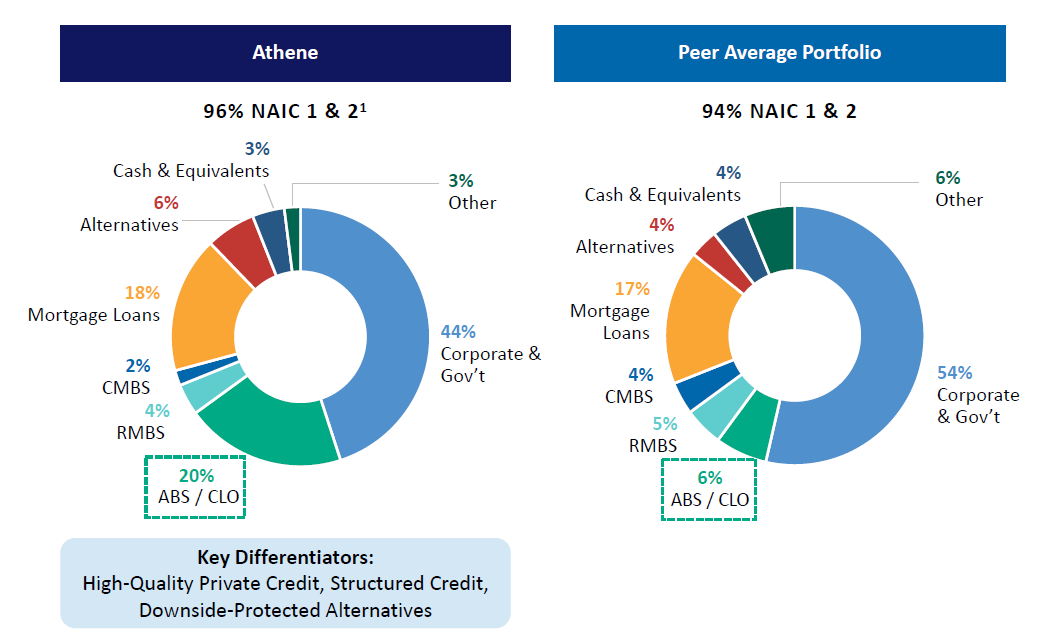

Athene invests those pension assets differently from the average life insurer, with Athene investing a comparatively higher percentage in complex and illiquid assets.

According to Athene’s February 2023 presentation, Athene’s Net Invested Assets included 26% in illiquid asset-backed securities [ABS], collateralized loan obligations [CLOs] and alternative investments, versus an average of 10% among its peers. Those investments are shown in light green and red in Athene’s pie charts below.

To illustrate the potential risks in these types of investments, in October, 2022, The Wall Street Journal reported that the CLO market faced “’the heaviest selling pressure we’ve ever seen,’ said Tom Majewski, managing partner at Eagle Point Credit Management, a Greenwich, Conn.-based investment firm specializing in CLOs.”[3] That unexpected crash in the U.K. currency and government bond market caused margin selling of CLOs, causing prices to decline “to their lowest levels since May of 2020.”[4]

Athene bought more CLO assets in that market decline, but what if a pricing crisis becomes longer-lasting in the future?

The U.S. Department of Labor Interpretive Bulletin 95-1 states “…fiduciaries choosing an annuity provider for the purpose of making a benefit distribution must take steps calculated to obtain the safest annuity available, unless under the circumstances it would be in the interests of participants and beneficiaries to do otherwise.”[5]

Pension fiduciaries need stronger guidance from the U.S. Department of Labor on how to assess life insurers like Athene who are changing the complexity of assets backing pension payments, so that pensioners will have the “safest annuity available”.

“’We know that workers end up worse off when Wall Street private-equity firms get involved,’ Mr. Brown said during the [pension] hearing. ‘We’ve seen it over and over again in industry after industry.’”[6]

Senator Sherrod Brown

[1] https://www.wsj.com/articles/private-equitys-pension-plan-takeovers-face-backlash-11665136802 Private Equity’s Pension-Plan Takeovers Face Backlash, 10/7/2022

[2] https://www.pbgc.gov/guidance/annuities accessed 5/19/2023

[3] https://www.wsj.com/articles/u-k-crisis-spills-into-u-s-junk-debt-11665440122 10/11/2022

[4] https://www.wsj.com/articles/u-k-crisis-spills-into-u-s-junk-debt-11665440122 10/11/2022

[5] 29 CFR § 2509.95-1 Interpretive Bulletin 95-1 https://www.law.cornell.edu/cfr/text/29/2509.95-1

[6] https://www.wsj.com/articles/private-equitys-pension-plan-takeovers-face-backlash-11665136802 Private Equity’s Pension-Plan Takeovers Face Backlash, 10/7/2022